More Deposits

More Account Holders

More Growth

Keep Account Holders — and their assets — with your institution while helping them build a financially secure future.

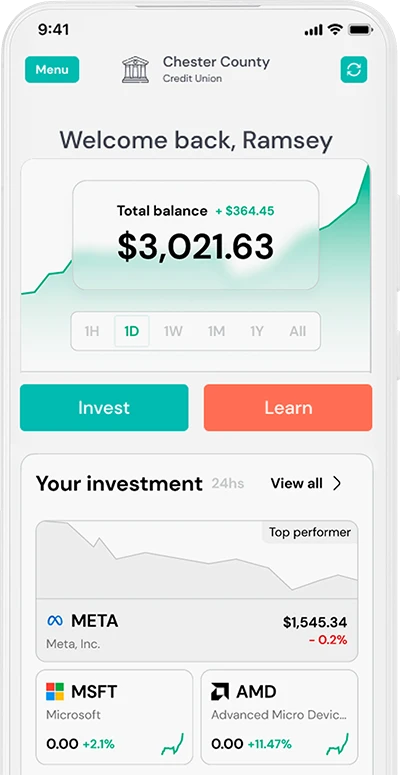

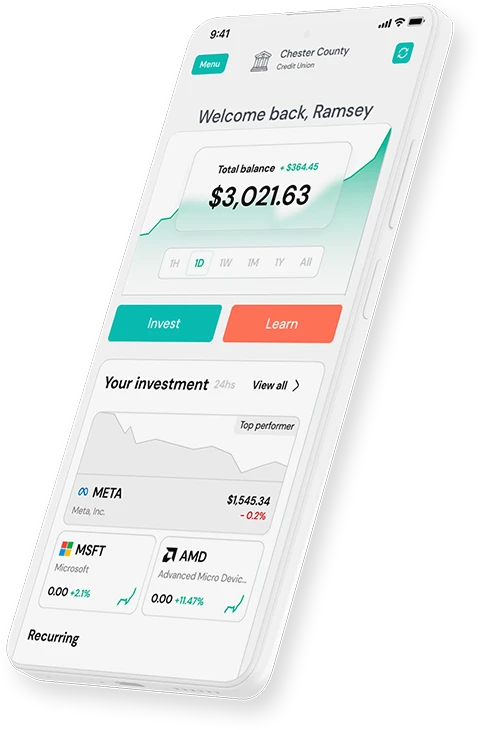

InvestiFi’s self-directed investment solution integrates seamlessly into your existing digital banking platform to help retain deposits and existing Account Holders while attracting new ones.

Benefits

Bring investing inside.

Don’t lose Account Holders’ funds — and loyalty — to FinTechs and external exchanges. Give them the tools to build their financial future through an online banking experience they already know and trust — yours!

Seamless for You

- Leverage our integration with your Digital Banking Provider and Banking Core to create a smooth and secure experience for all users

- Access our U.S.-based support for your needs AND your Account Holders

- Manage and increase engagement through our deep analytics and insights

Simple for Them

- Invest in any amount including fractional investing for as little as $1.00

- Buy, sell or hold stocks, ETFs and cryptocurrency directly from their checking account

- Use our robust investment educational resources for informed decision-making

Successful for All

- Give Account Holders access to the investing tools they want, including a Robo Advisor to rebalance portfolios according to risk tolerance and interest

- Keep Account Holder relationships and funds within your ecosystem

- Deliver a secure investing experience using the only InvestTech platform built to enable transactions to and from deposit accounts

About

Are you losing deposits, Account Holders and more?

At InvestFi, we saw a legion of Account Holders hungry to explore investing and a nation of Community Credit Unions and Banks losing assets to FinTech apps. So, we set out to bring self-directed investing to every Account Holder and Community Credit Union and Bank with a solution that’s secure, scalable and rooted in a “people helping people” mindset.

Press Release

September 30, 2024

“

Our Team

Meet our leadership

We have more than 150 years of combined experience in financial institutions, FinTech, engineering and product development.

CEO / Board Member

10+ years founding and scaling successful companies within the tech and finance sectors.

Board Member

30+ year entrepreneur with a demonstrated history of starting, growing and exiting business in the technology industry.

Chief Product Officer

12+ years in project management across Fortune 500 and startup companies

Chief Compliance Officer

17+ years of regulatory, compliance, and financial risk management experience

VP Marketing

20+ years creating and implementing successful integrated marketing programs for startups and Fortune 500 companies.

Advisor

15+ years’ experience leading double- and triple-digit growth at financial firms.

Advisor

25+ years of delivering results by applying sound business principles, strong leadership skills, and the ability to think creatively.

Ready for a demo?

Sign up now!